Table of Contents

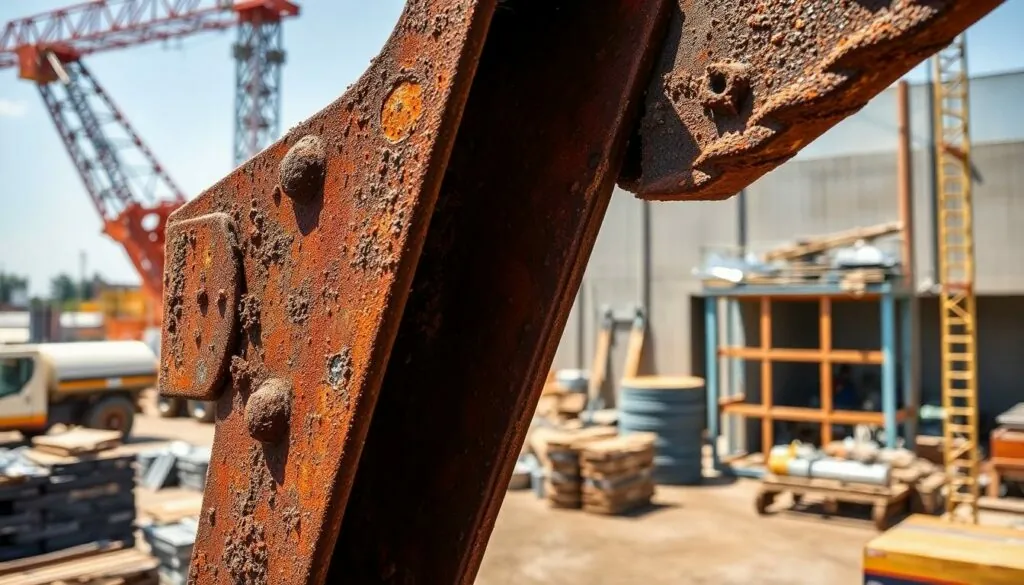

ToggleRust might not be the first thing that comes to mind when thinking about investment opportunities, but this often-overlooked commodity has a fascinating price history that’s as unpredictable as a cat on a hot tin roof. From its humble beginnings to its role in the booming construction industry, understanding rust’s price fluctuations can reveal valuable insights for savvy investors and curious minds alike.

Overview of Rust Price History

Rust prices have demonstrated considerable volatility over the years. Data from various market reports indicate significant fluctuations influenced by supply and demand dynamics. In early 2020, the price remained relatively stable at $350 per ton. However, by mid-2021, prices escalated sharply due to increased demand in the construction sector, reaching a peak of $650 per ton.

Factors such as geopolitical tensions and changes in trade policies heavily impacted pricing. For example, tariffs enacted in 2018 caused a notable price surge as manufacturers faced higher operational costs. Seasonal changes also contribute to price variation. Historically, demand increases during the spring and summer months, aligning with construction activity. Price dips typically occur in the colder months when construction projects slow down.

Additionally, environmental regulations have prompted changes in production methods that can affect supply levels. These regulations often lead to increased costs for producers, which in turn impacts market prices.

Investment opportunities in rust may lie in understanding these patterns. Analysts suggest anyone interested in investing should track historical trends over the past decade. Monitoring announcements related to infrastructure spending can also provide insight into future price movements.

Rust’s price history presents both challenges and opportunities for investors. By analyzing key historical data points, investors can better assess market conditions and devise informed strategies.

Factors Influencing Rust Prices

Several elements affect rust prices, primarily stemming from supply and demand dynamics as well as broader economic indicators.

Supply and Demand Dynamics

Supply and demand exert significant influence on rust pricing. An escalating need for construction materials typically results in price increases, as seen in mid-2021 when prices soared to $650 per ton. Sudden disruptions in production due to natural disasters or labor strikes can tighten supply, pushing prices higher. Conversely, an oversupply may lead to price drops, reflecting the delicate balance in the market. Seasonal fluctuations, particularly during peak construction periods, also play a crucial role in shaping demand and pricing.

Economic Indicators

Economic indicators serve as important signals for rust prices. Growth in the construction sector usually correlates with rising rust prices. Increases in infrastructure spending announcements impact investor confidence, reinforcing demand for rust. Additionally, shifts in global economic conditions, such as interest rates and inflation, can alter investment behaviors related to commodities like rust. Monitoring these indicators allows investors to anticipate future market movements effectively.

Historical Price Trends

Rust prices demonstrate notable volatility, making an understanding of past trends essential for investors and industry stakeholders. Factors such as geopolitical issues and changing regulations heavily influence these price movements.

Major Price Fluctuations

The price of rust experienced significant shifts between early 2020 and mid-2021. Prices stabilized at $350 per ton in early 2020 but surged to $650 per ton by mid-2021. Such increases resulted from heightened construction demand amidst infrastructure projects. Additionally, global disruptions, including supply chain issues and trade policies, have further exacerbated price volatility. Seasonal factors also play a role; periods of heavy construction typically see spikes in demand, leading to price increases.

Comparisons with Other Commodities

When comparing rust to other commodities, its price trends often parallel those of steel and copper. Both steel and copper have exhibited similar patterns of demand driven by infrastructure investments. During economic growth phases, demand typically rises, causing prices for all three materials to increase. Furthermore, rust’s pricing cycles are reflective of broader commodity markets affected by similar economic indicators. Understanding these comparisons helps investors formulate strategies, recognizing that rust’s market movements often imitate those of its closely related counterparts.

Current Market Analysis

Current trends in the rust market reveal a dynamic landscape influenced by various factors. Prices fluctuate based on supply, demand, and economic conditions.

Price Forecasts

Forecasting rust prices involves analyzing current market dynamics and historical data. Predictions indicate a potential increase in prices as construction demand continues to rise. Analysts expect prices may reach up to $700 per ton by the end of 2023, driven by infrastructure development initiatives. Seasonal demand peaks during summer months could lead to short-term price spikes. Monitoring global economic trends helps gauge potential shifts, ensuring informed investment decisions.

Expert Opinions

Experts emphasize the complexity surrounding rust pricing in the current market. Influential factors include geopolitical tensions and production costs, which could affect future pricing. Insights from industry analysts suggest cautious optimism, particularly as infrastructure spending increases. Various forecasts indicate that while hiccups may arise, investment in rust remains favorable. Staying informed about technological advancements and environmental regulations enhances understanding of potential market movements. Engaging with expert analyses helps stakeholders navigate this volatile market effectively.

Conclusion

Rust’s price history reveals a complex interplay of factors that influence its market value. Understanding these dynamics is essential for investors looking to capitalize on opportunities within this commodity. As demand in the construction sector continues to rise, the potential for price increases remains strong.

Monitoring economic indicators and geopolitical developments will be crucial for making informed investment decisions. With the ongoing evolution of infrastructure projects and environmental regulations, staying ahead of market trends can provide a competitive edge. Engaging with expert analyses can further enhance one’s understanding of rust’s price movements, paving the way for strategic investments in this often-overlooked market.